What is Unit Economics?

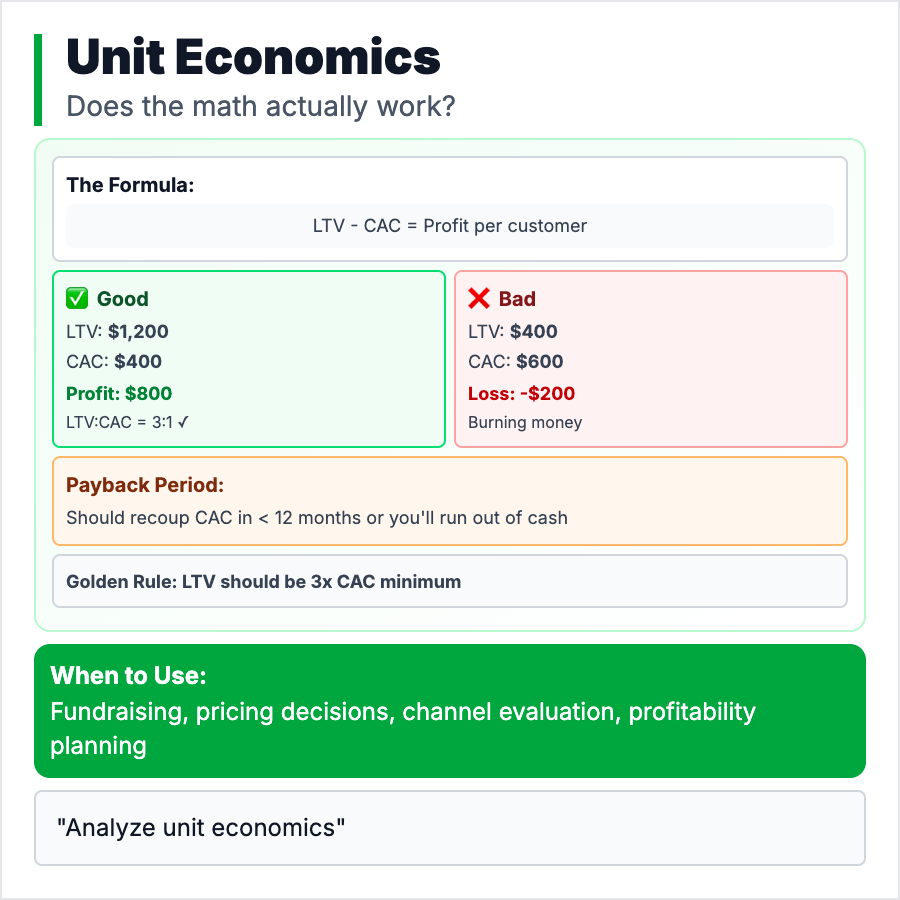

Unit Economics answer: "Do I make money on each customer?" Specifically, is your Customer Lifetime Value (LTV) greater than your Customer Acquisition Cost (CAC)? Good unit economics: LTV/CAC ratio of 3:1 or higher. If you spend $100 to acquire a customer who generates $500 in profit over their lifetime, your unit economics work. If LTV < CAC, you lose money on every customer—growth makes it worse.

When Should You Use This?

Track unit economics as soon as you have paying customers and understand retention. Essential before scaling marketing spend—you need to know if acquiring more customers is profitable. Critical for fundraising—investors want to see a path to profitability. If your unit economics don't work, fix them before scaling (raise prices, reduce CAC, improve retention).

Common Mistakes to Avoid

- •Ignoring churn—if customers leave quickly, LTV is much lower than you think

- •Not including all costs—CAC includes sales, marketing, onboarding, not just ads

- •Optimizing too early—unit economics matter less before Product-Market Fit

- •Comparing across cohorts—newer cohorts often have worse economics, track by cohort

- •No payback period—even with good LTV/CAC, you need to recoup CAC within 12 months

Real-World Examples

- •Typical SaaS—$100 CAC, $50/mo subscription, 2-year retention = $1,200 LTV (12:1 ratio)

- •Airbnb—Host/guest acquisition costs, take rate per booking, repeat booking rate

- •Dropbox—Freemium CAC near $0, paid conversion rate, multi-year retention

- •DTC brand—$30 CAC, $100 average order, 3 orders/customer lifetime = $300 LTV (10:1)

Category

Product Management