What is CAC (Customer Acquisition Cost)?

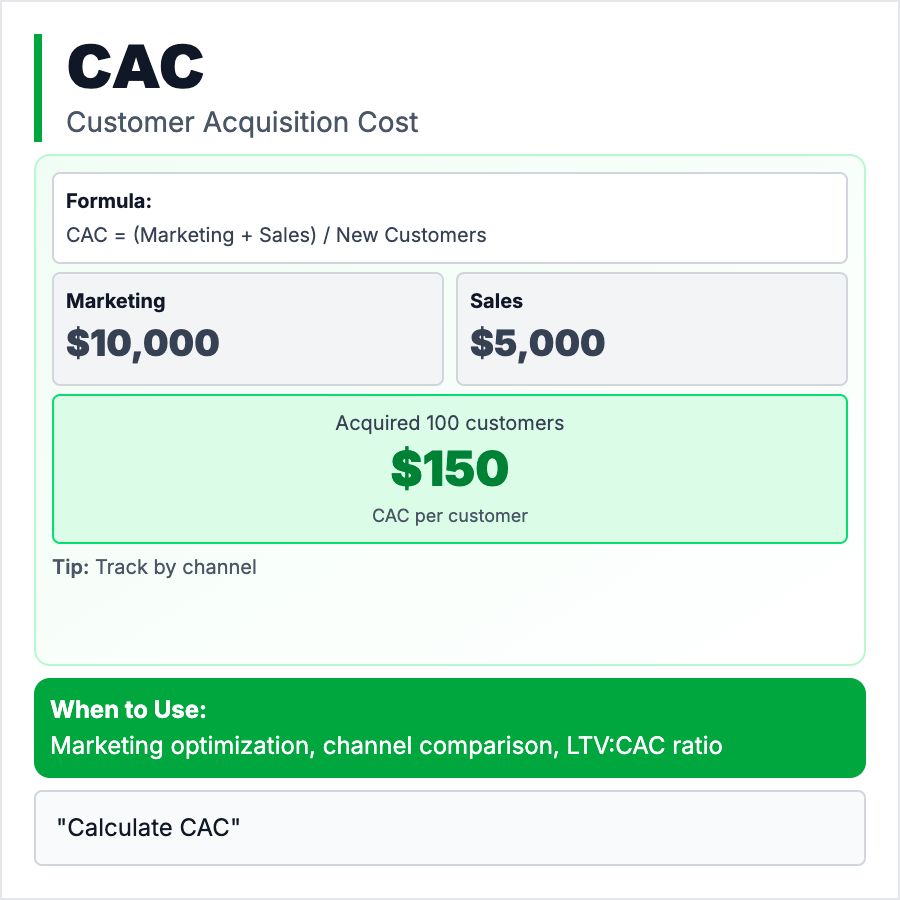

CAC (Customer Acquisition Cost) is how much you spend to acquire one customer. Formula: (Sales + Marketing Costs) ÷ Number of New Customers. Include salaries, ads, tools, everything. Example: Spend $10,000/month, acquire 100 customers = $100 CAC. Compare to LTV—aim for LTV/CAC ratio of 3:1 or higher. Lower CAC = more profitable growth. Payback period should be <12 months.

When Should You Use This?

Track CAC as soon as you start spending on acquisition (ads, sales team, marketing). Break it down by channel (Google Ads CAC vs organic CAC), customer segment (SMB vs enterprise), and cohort (CAC often rises over time). Use it to decide which channels to scale and when unit economics work. Essential for understanding if growth is profitable.

Common Mistakes to Avoid

- •Only counting ad spend—CAC includes salaries, tools, agencies, everything

- •Not segmenting—organic CAC is near zero, paid can be $500+, average is misleading

- •Ignoring payback period—even with 3:1 LTV/CAC, if payback takes 3 years you run out of cash

- •Blending timelines—use monthly CAC ÷ monthly new customers, not yearly totals

- •No channel attribution—you need to know which channels have best CAC

Real-World Examples

- •Dropbox—$0 CAC via referral program (viral growth), avoided paid ads early

- •Enterprise SaaS—$5,000+ CAC (sales team), justified by $50,000+ LTV

- •Consumer app—$5-20 CAC via Facebook Ads, needs high volume to work

- •Product-led growth—Notion/Figma have low CAC via organic/viral, then expand accounts

Category

Product Management

Tags

caccustomer-acquisition-costmetricsmarketingunit-economics