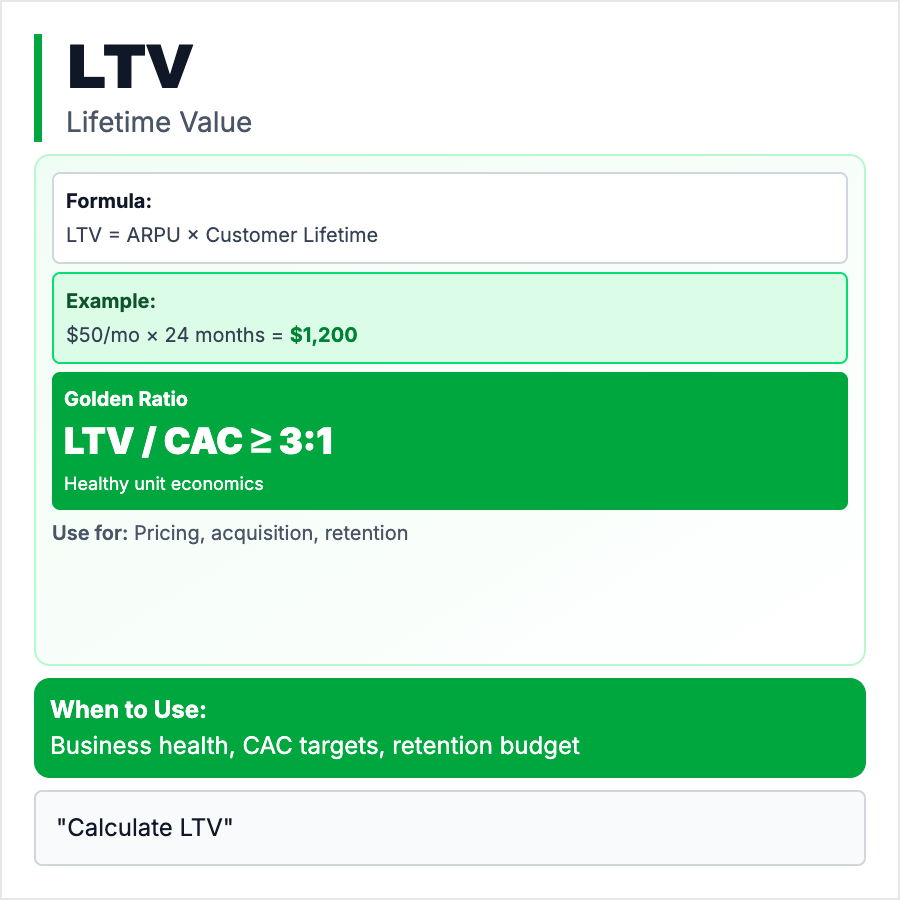

What is LTV (Lifetime Value)?

LTV (Lifetime Value) is the total profit a customer generates over their entire relationship with you. Formula: (Average Revenue Per User × Gross Margin) ÷ Churn Rate. Example: $100/mo subscription, 80% margin, 5% monthly churn = $1,600 LTV. Used with CAC to determine if your business model works (aim for LTV/CAC > 3). Higher LTV means you can spend more to acquire customers.

When Should You Use This?

Calculate LTV once you have paying customers and understand churn. Use it to decide how much to spend on acquisition (CAC should be <1/3 of LTV), which customer segments to target (enterprise has higher LTV), and whether to raise prices. Track LTV by cohort—newer cohorts often have different behavior. Essential for fundraising and understanding unit economics.

Common Mistakes to Avoid

- •Using revenue instead of profit—LTV is profit after costs (gross margin)

- •Assuming zero churn—even "annual contracts" have renewal rates, factor that in

- •Ignoring expansion—some customers upgrade over time, include expansion revenue

- •Not discounting—LTV should use net present value if customer lifetime is multi-year

- •Comparing cohorts wrong—early adopters often have higher LTV than later customers

Real-World Examples

- •SaaS—$50/mo, 80% margin, 3% churn, 2-year avg lifetime = $1,600 LTV

- •E-commerce—$80 avg order, 40% margin, 4 orders lifetime = $128 LTV

- •Spotify—~$10/mo, 70% margin, low churn, multi-year retention = $400+ LTV

- •Slack—Starts low, expands over time (more seats), LTV grows significantly

Category

Product Management