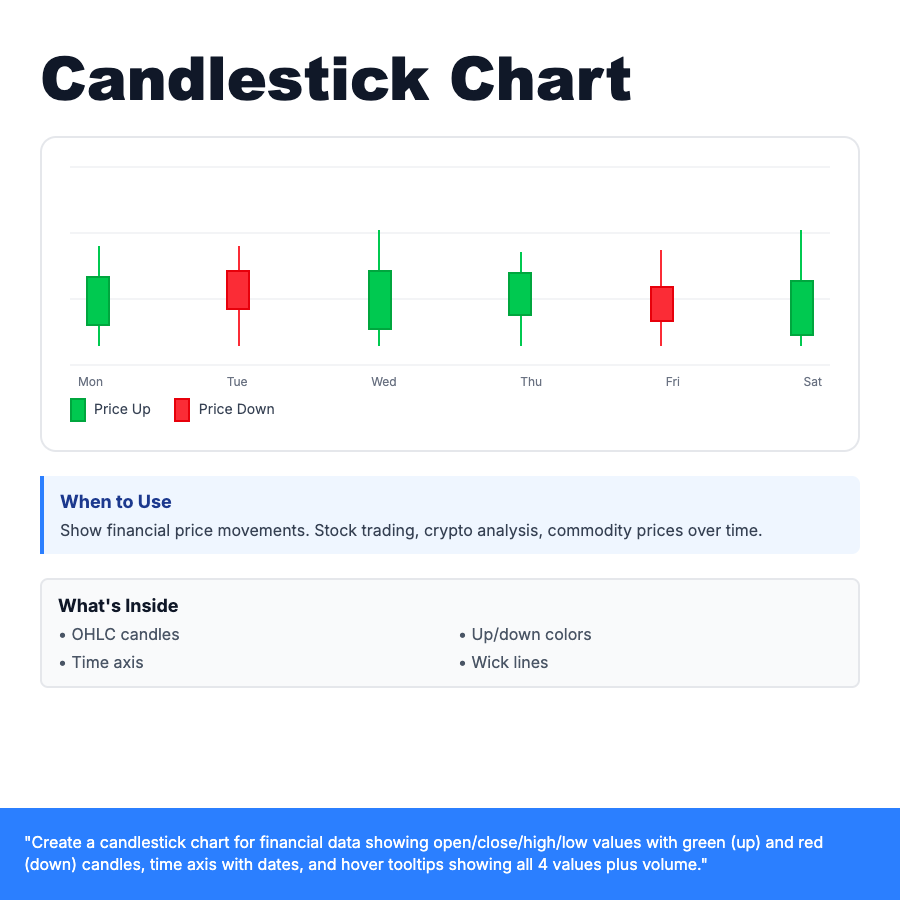

What is Candlestick Chart?

Candlestick chart displays financial data (stocks, crypto) showing four values per time period: Open, High, Low, Close (OHLC). Each candle has a body (open to close) and wicks (high/low extremes). Green candle = price up (close > open), red candle = price down (close < open). Essential for technical analysis and trading.

When Should You Use This?

Stock trading platforms, cryptocurrency exchanges, commodity price tracking, forex analysis. Best for showing price movement patterns over time with granular detail. Use daily, hourly, or minute-level candles. Traders use patterns (doji, hammer, engulfing) to predict future movements. Combine with volume bars and moving averages.

Common Mistakes to Avoid

- •No volume bars—add volume chart below to show trade activity

- •Wrong colors—stick to green (up) and red (down) convention

- •Missing tooltips—show exact OHLC values + % change on hover

- •Too many candles—limit visible range, add zoom/pan controls

Real-World Examples

- •Robinhood—stock price candlestick chart with 1-day, 1-week, 1-month views

- •Coinbase—Bitcoin price chart with hourly candles and volume

- •TradingView—advanced charting with indicators and patterns

Category

Data Visualization

Tags

candlestickohlcstock-charttradingfinancialcryptopricedata-viz